Hey Folks,

We are back with this week’s case study issue on Veeba!

Hope you have a good read, also make sure to follow us on instagram, we post dope content there as well - https://www.instagram.com/theadvertisersalmanac/

Brand Background

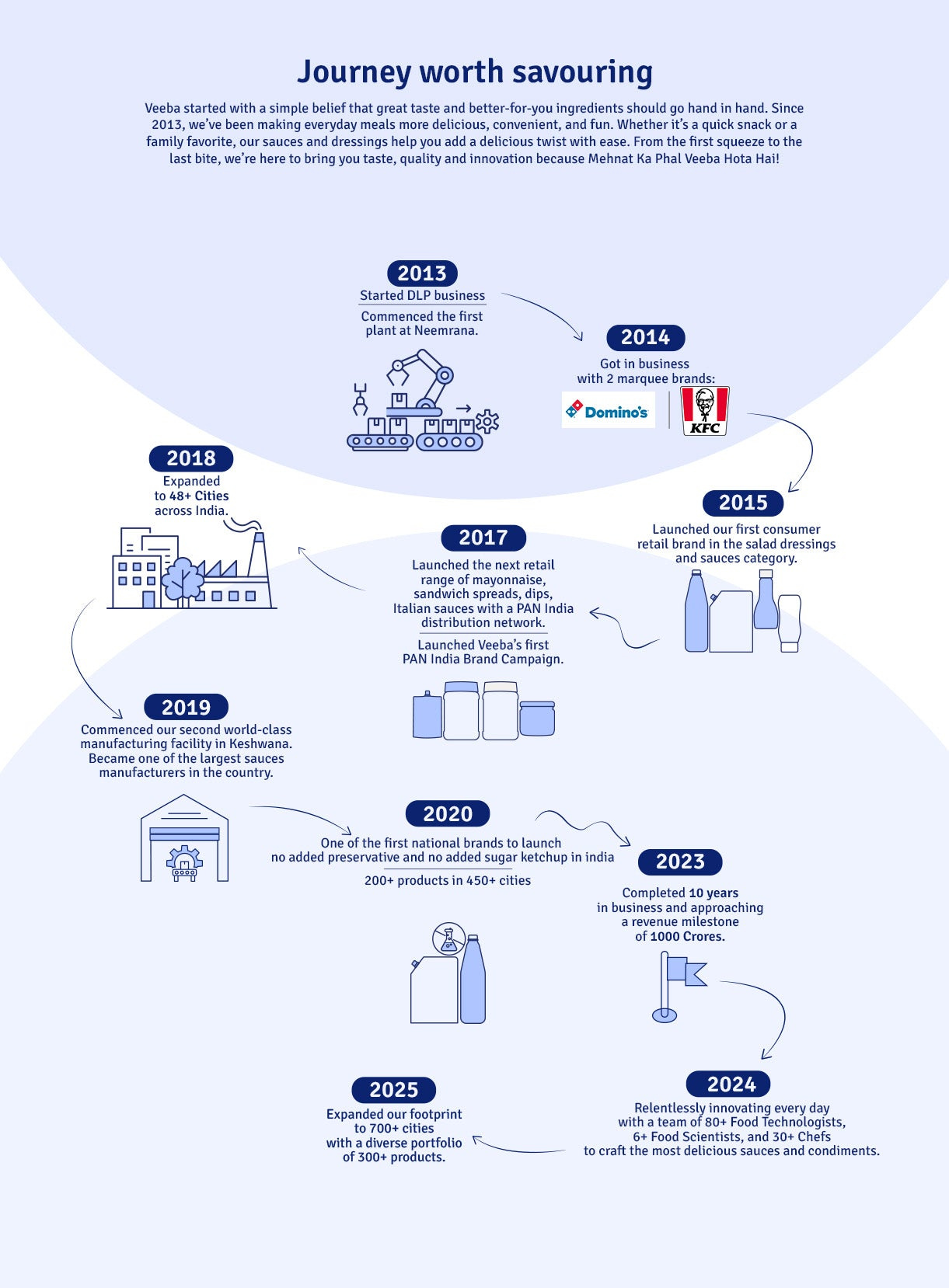

Founded in 2013 by Viraj Bahl, Veeba started as a B2B supplier of sauces, dressings, and spreads to fast food giants like Domino’s, KFC, and Starbucks.

But soon, Veeba made a pivot into the B2C market, entering Indian kitchens with international-quality sauces like Chipotle Mayo, Pizza Pasta Sauce, and Thousand Island Dressing. All this while being positioned as “healthy and tasty”.

🔍 The Gap

Before Veeba:

"Mayonnaise" was alien to most Indian households.

Sauces meant Maggi ketchup—that’s it.

International sauces were either imported (costly) or subpar locally made products.

Parents were skeptical of sauces due to preservatives, high-fat content, and sugar.

In short: There was no Indian brand owning the ‘fun + health’ space in condiments.

The Strategy

Veeba’s masterstroke? A category-creation + education + health-conscious parenting play.

Here’s the breakdown:

“Restaurant-style taste at home” – bring café-quality sauces to Indian kitchens.

Health-first positioning – low-fat, zero trans fat, no synthetic colors.

Target: Modern, young parents who are:

Looking to “jazz up” kid’s meals

Concerned about nutrition

Pricing between mass and premium – not cheap, not luxury.

🎯 Execution

1. Product Innovation

100+ variants of sauces, spreads, and dressings

Indian twists like Tandoori Mayo, Schezwan Chutney, and more

Squeeze bottles for convenience

2. Communication = Simplicity + Trust

Visual-heavy packaging: colorful, clean, and easy to understand

Clear messaging: “No MSG”, “Low Fat”, “No Preservatives”

Brand tone: Friendly, modern, and helpful

3. Influencer & Mommy Marketing

Collaborated with mom bloggers and food creators

Focused on kid-friendly recipes and lunchbox hacks

Social media full of “3-min healthy snacks” using Veeba

4. Retail Strategy

Grabbed premium shelf space in modern retail outlets

Simultaneously expanded into kiranas with small SKUs

5. B2B to B2C Halo

Already in people’s mouths (literally) via Domino’s, Subway etc.

Created a perception of “This is what big brands use, must be good”

The Results

From ₹0 to ₹250+ Cr revenue in under a decade

350+ towns across India

Became India’s #2 mayo brand after Dr. Oetker

Expanded into peanut butter, dessert toppings, and jams

Created V-Nourish, a health drink brand (sold later)

Competed head-on with multinationals like Nestlé and Hindustan Unilever in condiments

Key Takeaways

✅ Start B2B, go B2C once credibility is built

✅ Health + Taste = Sweet spot in Indian kitchens

✅ Visual simplicity wins trust on shelves

✅ Micro-influencers and moms = high-impact brand advocates

✅ Innovation keeps the shelf exciting – don’t rely on one hero product

Financial Snapshot and other news

FY23 Revenue: ₹811 crore (Source : Forbes)

FY24 Target: On track to surpass ₹1,000 crore

Retail Focus: 92% of sales from B2C channels

Product Expansion: Launched 'WokTok'—a range of Chinese and Pan-Asian sauces and cup noodles tailored for Indian tastes.

Growth Strategy: Plans to introduce four new brands across seven categories by 2028, aiming to evolve beyond condiments.